Online farmland investing system AcreTrader announced this 7 days an expansion of its oversubscribed $40 million Collection B funding, which was initial manufactured public in January. This brings its full in the elevate to $60 million, next a new investment from Columbus, Ohio–based venture capital organization Travel Cash.

Founder and CEO Carter Malloy reported the more funding would be set towards continued growth of the company’s technological know-how and head count, which has grown from 15 in early 2020 to 80 right now.

“RIAs are continuously searching for new methods that they can increase price to their consumer foundation, which is more and more intrigued in exposure to alternative investments exterior of the conventional 60/40 shares and bonds allocation,” explained Malloy.

The startup, which to start with introduced in 2018, takes advantage of its technological know-how platform to match farmers and sellers of farmland with traders and prospective buyers.

“To commit in farmland in the previous, investment decision advisors would have to assistance their consumer by a very arduous course of action of analyzing an asset class they are not acquainted with,” he mentioned, including that the upfront cash necessary to acquire an total farm would typically avert their clients from participating.

“Despite eye-catching historic performance, it was incredibly exceptional for any investor to even contemplate farmland as an investment decision prospect,” mentioned Malloy.

The AcreTrader platform at present delivers a number of financial commitment prospects each individual week and makes it much simpler for intrigued advisors and their purchasers to investigate their options.

With it, Malloy stated that RIAs are capable to introduce their shoppers to a significant-undertaking but unfamiliar asset class in an approachable method and assist them diversify their portfolios with farmland significantly extra immediately, effortlessly and in a compliant manner.

AcreTrader also introduced programs to develop its system referred to as AcrePro, a land brokerage software supposed to simplify evaluating, marketing and purchasing farmland for all events from agents to buyers and sellers.

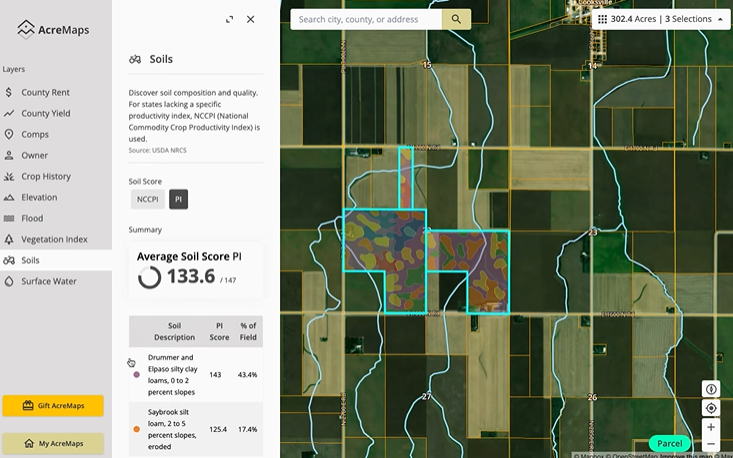

The funding will also be made use of to make a geospatial analytics platform for land valuation.

A screenshot of the AcreTrader geospatial system, at the moment less than beta.

RZC Investments, started by heirs of Walmart founder Sam Walton, led an initial oversubscribed $5 million seed round in AcreTrader in April 2020. This was adopted a year afterwards by a $12 million Collection A funding spherical, led by Bounce Cash. Narya Capital, Revolution’s Rise of the Rest Seed Fund, and existing traders RZC Investments and Revel Partners also participated.

More Stories

4 takeaways from the Investing Club’s ‘Morning Meeting’ on Monday

Investing Is More Important Now Than Ever Before | Personal Finance

Nornickel Investing in Exoskeletons for Workers’ Efficiency, Health Protection