Using the occasional decline arrives section and parcel with investing on the stock sector. And sad to say for Cimpress plc (NASDAQ:CMPR) shareholders, the stock is a lot lessen right now than it was a calendar year back. The share selling price is down a hefty 56% in that time. Even if you seem out a few many years, the returns are even now disappointing, with the share cost down52% in that time. Shareholders have had an even rougher operate these days, with the share price down 31% in the past 90 days.

So let us have a glimpse and see if the longer term effectiveness of the organization has been in line with the underlying business’ development.

See our most recent evaluation for Cimpress

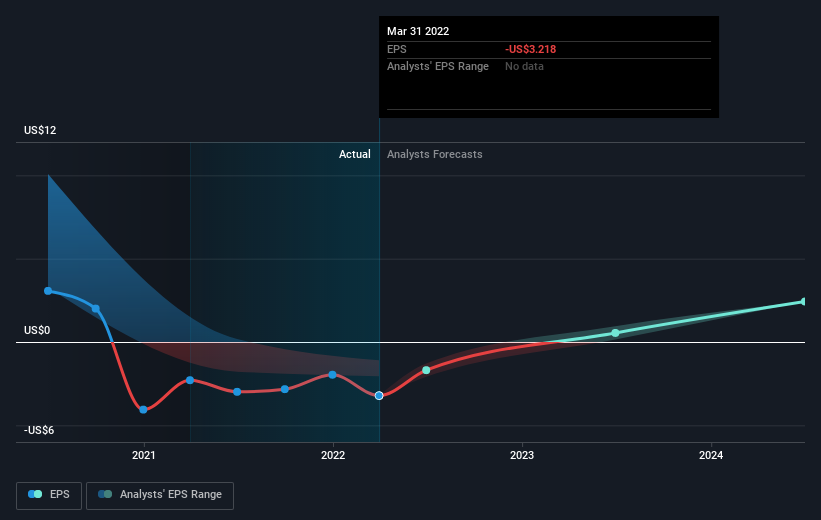

When the efficient markets speculation carries on to be taught by some, it has been verified that markets are over-reactive dynamic units, and buyers are not constantly rational. One way to examine how marketplace sentiment has changed about time is to glimpse at the interaction amongst a firm’s share rate and its earnings for every share (EPS).

Sadly Cimpress claimed an EPS fall of 40% for the final yr. Visitors ought to not this result was influenced by the impression of amazing things on EPS. And indeed the business shed money about the past twelve months. This reduction in EPS is not as poor as the 56% share value drop. This indicates the EPS tumble has created some shareholders are much more anxious about the small business.

The firm’s earnings for every share (over time) is depicted in the image below (click on to see the specific figures).

Before getting or advertising a inventory, we always propose a near assessment of historic development tendencies, available in this article.

A Distinct Point of view

Although the broader industry lost about 12% in the twelve months, Cimpress shareholders did even worse, dropping 56%. Even so, it could basically be that the share selling price has been impacted by broader current market jitters. It may possibly be worth trying to keep an eye on the fundamentals, in situation there is a great option. Regrettably, very last year’s general performance caps off a terrible run, with the shareholders facing a total decline of 9% for every 12 months over 5 several years. Generally talking long expression share selling price weakness can be a terrible indicator, even though contrarian investors might want to exploration the stock in hope of a turnaround. Whilst it is well well worth contemplating the distinct impacts that market circumstances can have on the share price tag, there are other factors that are even much more essential. Like pitfalls, for occasion. Just about every firm has them, and we’ve noticed 2 warning indications for Cimpress (of which 1 should not be ignored!) you should know about.

Of course Cimpress might not be the greatest stock to buy. So you may wish to see this absolutely free selection of progress shares.

Make sure you observe, the sector returns quoted in this article mirror the market weighted average returns of stocks that at the moment trade on US exchanges.

Have responses on this article? Anxious about the articles? Get in touch with us immediately. Alternatively, e-mail editorial-staff (at) simplywallst.com.

This write-up by Merely Wall St is common in character. We supply commentary primarily based on historic facts and analyst forecasts only applying an unbiased methodology and our posts are not intended to be economical advice. It does not represent a suggestion to invest in or market any inventory, and does not get account of your targets, or your fiscal scenario. We purpose to bring you prolonged-term concentrated examination pushed by elementary knowledge. Be aware that our investigation might not issue in the most recent price tag-sensitive enterprise announcements or qualitative content. Basically Wall St has no situation in any shares mentioned.

More Stories

4 takeaways from the Investing Club’s ‘Morning Meeting’ on Monday

Investing Is More Important Now Than Ever Before | Personal Finance

Nornickel Investing in Exoskeletons for Workers’ Efficiency, Health Protection