The inventory market is a bizarre animal. Share price tag reactions to news releases often pattern counter to what you would be expecting.

That was certainly the scenario on Thursday early morning with footwear specialist Designer Brand names (DBI) .

Its fiscal to start with-quarter report, whose quarter ended April 30, beat on equally earnings and earnings. Administration raised comprehensive-year assistance to among $1.90 and $2 per share, a new all-time report. The upcoming dividend was declared, as properly.

DBI’s pre-current market cost jumped into the reduced $16s, up 4.25% as of 8:13 a.m. That was what I envisioned centered on the excellent news.

At that time, the shares ended up up over 44% from their March 7 nadir and about 30.6% from where they sat just two weeks back.

People very low points proved how erratic, and detached from fundamentals, market motion can be: DBI altered hands at $20.50 all through Might of 2021, just in excess of a yr before.

Irrespective of a stellar fiscal 2021, which finished with earnings per share of $1.69, the shares had fallen by larger than 45% at final March’s bottom tick.

What is DBI definitely worthy of?

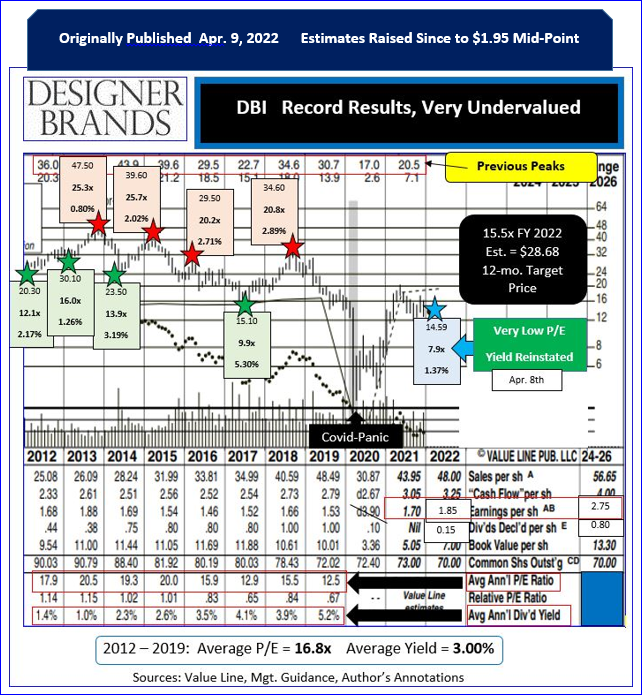

The graphic below is from my April 9 column, when the inventory was hovering in the mid-$14 spot. At that time, the consensus watch for fiscal 2022 was for $1.85 in earnings for each share. Following modern announcement the mid-point of management’s guidance has been raised an additional 5.4%, to $1.95.

Pre-Covid, DBI generally fetched about 16.8-instances earnings, while delivering reasonably dependable gains year right after yr. The inventory altered arms way greater than it does at the moment even nevertheless EPS were fewer than what is anticipated this yr.

Believe a nevertheless below regular various of 15.5-situations on fiscal 2022’s new estimate and the 12 months in advance concentrate on cost would now be north of $30. Reverting again to $30 would provide better than a 90% increase, plus any dividends attained alongside the way.

That explains why insider purchasing of $18.7 million, generally from the CEO, took location from March 2021 via September 2021 at an regular price tag of $13.84 or so.

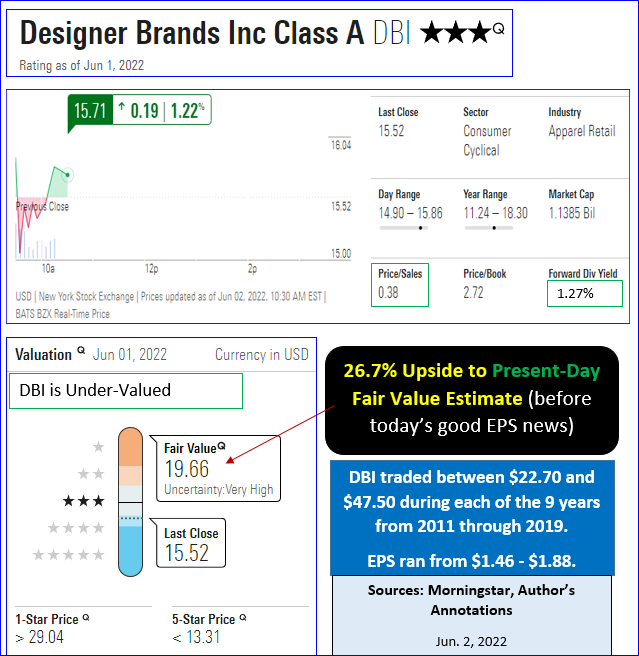

Before being aware of about the better-than-anticipated success, exploration house Morningstar inexplicably had DBI labeled “neutral.” Why was that shocking to me? Its possess current-day good benefit estimate for DBI was $19.66, virtually 27% above DBI’s June 1 closing quote.

In addition, DBI frequently traded amongst $30 and $40 in the previous on EPS which have been not as very good as present-day.

Shockingly, once standard trading hours started, DBI briefly sunk again to as lower as $14.90 intraday. By 10 a.m., the shares ended up still readily available at $15.39.

Thursday therefore offered us with nonetheless an additional chance to engage in DBI at way considerably less than any rational cost level.

Buying shares outright however offers the most effective prospect to make significant gains with no predetermined higher restrict and no preset time horizon.

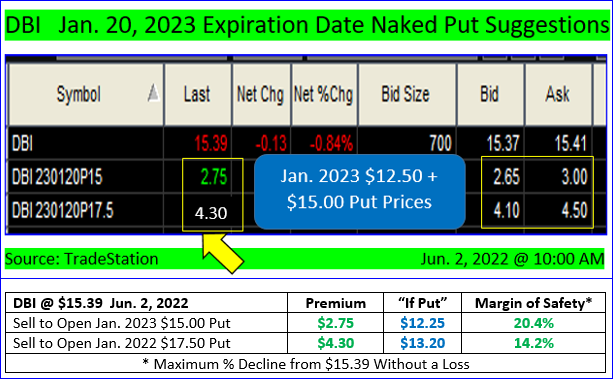

Choice-traders can nonetheless pocket superb premiums for offering bare places out to Jan. 20, 2023. Real pricing on the $15 and $17.50 strike rate places, with DBI at $15.39 are revealed below.

Worst-circumstance, pressured order selling prices dropped to either $12.25 or $13.20 relying on the strike price ranges utilized.

I was by now prolonged DBI shares and short July and Oct expiration places going into present day investing. Right after viewing the excellent information, I shorted an further 38 contracts of DBI’s January $15 puts to go with them.

My typical “if exercised” selling price on these averaged $12.27 for every share. That is a value at which I would be pleased to possess extra DBI. By definition, it is really also a selling price decrease than the firm’s CEO, who is familiar with ideal what the firm is really worth, paid out to obtain additional DBI very last calendar year.

Legitimate believers might uncover the further upside from promoting $17.50 strike selling price places more beautiful than the $15s as the worst-scenario purchase value is however a cut price at $13.20 or so.

Invest in some DBI shares, provide some DBI puts or consider undertaking both of those.

(Be aware: Fantastic recent benefits from Boot Barn (BOOT) and Caleres (CAL) show up to validate that the footwear enterprise is booming and exhibiting no signals of letting up.)

Get an electronic mail notify every time I write an write-up for Genuine Dollars. Simply click the “+Comply with” following to my byline to this short article.