Hanasaki/iStock by using Getty Photos

By Christopher Gannatti, CFA and Elvira Kuramshina

Though there are not ‘do-overs’ in investing – you cannot go again to a distinct time, choose a distinct motion and then participate in events as they transpired forward to the current – we can continue to master a lot from history.

Feel of a number of illustrations of massive downdrafts:

- In March 2020, considerably of the globe did not know what was likely to happen up coming. There was not a obvious playbook for how to offer with a international pandemic. Formulated markets have been locking down and it just was not apparent what the result would be.

- In 2008, it was not extremely hard to imagine that the U.S. govt would take a important ownership stake in quite a few of the biggest banks owing to the international economic disaster.

Several who experienced the March 2009 lows did not allocate to equities through the worst of that period. But they did stay by way of the results that followed and wished they experienced. It can be feasible they even predicted they would act differently the following time a very similar drop happened.

But did they, arrive March 2020?

These drops are useful in that they are so unique from each individual other, and nonetheless they are also very similar in their diploma of fear and uncertainty. Allocating to dangerous belongings in a interval of panic and uncertainty, when it does not appear probable to know what will come about upcoming, will never be straightforward. If the image was clearer, the downdraft would not be as significant.

If We Can’t Be Greedy When Many others Are Fearful, What Can We Do?

Even if we are not able to power ourselves to allocate through peak uncertainty, there are still possibilities.

At times, there can be major downdrafts inside of a individual market section. It could be less complicated to increase danger in these spots for the reason that other elements of your total asset allocation might be undertaking perfectly and getting some of the stress off producing a decision.

Computer software-concentrated cloud computing organizations in March 2022 could be one particular such sector section.

We search here at the BVP Nasdaq Emerging Cloud Index (EMCLOUD) constituents to make sure inferences about this market.

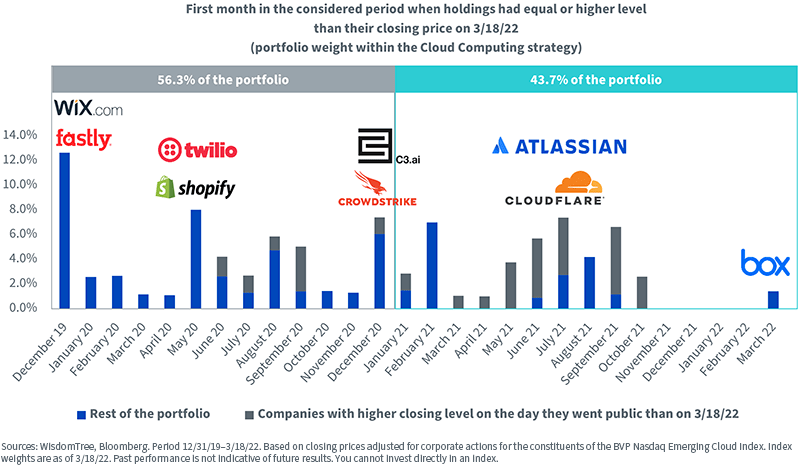

Figure 1 can be viewed as a veritable time device, in that traders can consider of cloud organizations exhibiting share price ranges at stages very similar to exactly where they had been at a specified time period in the earlier.

In effect, the new correction has reset the share costs to ranges reduce than before the start of the international pandemic, in some cases.

As we glance at the interval that starts December 31, 2019, there are particular corporations buying and selling better on that day than in March 2022.

In determine 1, their pounds is 12.7% of the BVP Nasdaq Rising Cloud Index, as of March 18, 2022. Total, 56.3% of the index is now allocated to organizations that even back in 2019-2020 had share charges at greater amounts than on March 18, 2022. Extra than a quarter of the portfolio body weight is in corporations that only went community in 2021, which means they did not have any value heritage in 2020. All of people businesses but one, that is, 24.7% of the portfolio fat, had their closing degree on the very first working day of investing above their closing level on March 18, 2022.1

- Wix.com (WIX) and Fastly (FSLY) are illustrations of businesses investing at ranges decrease than ahead of the world-wide lockdowns and prior to there was this sort of a detail as a ‘stay-at-home’ inventory. Wix.com experienced revenues of $761 million in 2019 and $1.27 billion in 2021. Revenue expansion may perhaps be decelerating, but it is continue to all-around 30%. Fastly has professional larger challenges. Its 2019 profits was $200 million, and $354 million last year. Income growth direction has been crushed – but it is really however carrying out at close to a 20% 12 months-over-calendar year determine. Fastly is associated in content delivery networks, and while it wouldn’t be immune from idiosyncratic challenges to its personal execution, there is minimal dilemma that individuals and organizations want much more articles at a higher quality and velocity around the online – not significantly less.

- Twilio (TWLO) and Shopify (Store) have been two of the strongest and most very well-operate enterprises within just the cloud computing market place, and share price ranges are now again to May 2020 ranges. In 2020, Shopify experienced revenue of $2.929 billion, whilst in 2021 revenue experienced developed to $4.612 billion. Shopify’s special privilege for undertaking so nicely in helping modest business enterprise house owners operate on-line storefronts is ending up on the radar display screen of Amazon.com (AMZN) – definitely a challenge. Twilio acquired $1.762 billion in earnings for the duration of 2020, escalating to $2.842 billion in 2021. It is between the most effective-in-course corporations that assistance application developers add communications capabilities to their purposes, and it’s crucial to talk to ourselves – are we predicting a world the place we use fewer programs?

Determine 1: A Time Equipment for Cloud Computing Companies

Buyers Preferred Much better Valuations (a Correction) and it Has Arrived

WisdomTree has targeted on cloud computing as an significant megatrend given that September 2019. Couple of recognized the tailwind to quite a few of these shares that societal actions in the course of the pandemic would offer, but background displays the returns of 2020 were being, in a word, outstanding.

Corporations were buying and selling at triple-digit ratios of business price to gross sales – indicating increased than 100 occasions. Numerous conversations regarded the price of what the firms ended up delivering, but investors have been skeptical that the progress premiums could be preserved. If valuations could get a lot more fair, there would be higher fascination.

As we glance at the house in March 2022, this correction has come.

It is now much more durable to come across firms buying and selling at an organization price to revenue ratios higher than 100 situations. Even though it is unachievable to know if the latest valuations adequately replicate all known hazards currently, an trader facing cloud computing nowadays most likely faces a lot less possibility of overvaluation than they did in November 2021.

1 Resource for revenue information in bullets: www.wsj.com, precisely the money statement info claimed for the specific providers

Essential Risks Related to this Report

Christopher Gannatti is an worker of WisdomTree Uk Restricted, a European subsidiary of WisdomTree Asset Management Inc.’s parent organization, WisdomTree Investments, Inc.

Christopher Gannatti, CFA, Worldwide Head of Exploration

Christopher Gannatti commenced at WisdomTree as a Analysis Analyst in December 2010, operating immediately with Jeremy Schwartz, CFA®, Director of Investigation. In January of 2014, he was promoted to Associate Director of Investigate in which he was dependable to direct unique groups of analysts and strategists inside of the broader Exploration workforce at WisdomTree. In February of 2018, Christopher was promoted to Head of Study, Europe, the place he will be primarily based out of WisdomTree’s London office environment and will be accountable for the entire WisdomTree analysis work within just the European current market, as perfectly as supporting the UCITs system globally. Christopher arrived to WisdomTree from Lord Abbett, where by he worked for four and a 50 percent many years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern Faculty of Organization in 2010, and he gained his bachelor’s diploma from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Economical Analyst designation.

Elvira Kuramshina, Senior Affiliate, Quantitative Study at WisdomTree Europe

Editor’s Observe: The summary bullets for this write-up were being decided on by In search of Alpha editors.

More Stories

4 takeaways from the Investing Club’s ‘Morning Meeting’ on Monday

Investing Is More Important Now Than Ever Before | Personal Finance

Nornickel Investing in Exoskeletons for Workers’ Efficiency, Health Protection